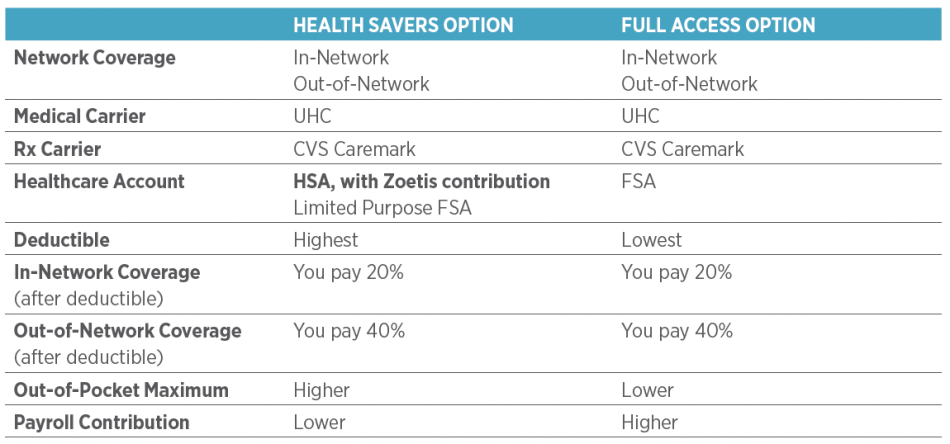

Medical Plan Options

Zoetis offers the following medical plan options. For each of these options, in-network preventive services are always covered at 100%.

Health Savers Option with a Health Savings Account (HSA)

- The UnitedHealthcare (UHC) Health Savers Option is a qualified high-deductible health plan.

- It pairs with a Health Savings Account (HSA) to help cover a significant portion of your annual deductible and other out-of-pocket medical costs.

- Zoetis contributes to your HSA: Employee only: $600, Other coverage levels: $1,200. (New hires who begin employment December 1 or later are not eligible to receive Zoetis HSA contributions for that calendar year.)

- Your payroll contributions are less in the Health Savers Option, so you pay less up front.

- The plan offers the choice between in- or out-of-network providers; your costs will be higher for out-of-network care.

- CVS Caremark administers the prescription drug plan.

Full Access Option

- The UHC Full Access Option offers the choice of using in- or out-of-network providers. Your costs will be higher for out-of-network care.

- For in-network doctor’s office visits and emergency room visits, copays apply.

- For all other medical services, such as hospital inpatient and outpatient services, a deductible and coinsurance apply.

- CVS Caremark administers the prescription drug plan.

Kaiser HMO Option—California

Available only to California colleagues who reside in an eligible ZIP code area

- The plan is a Health Maintenance Organization (HMO) that provides benefits only when you go to providers in the Kaiser California HMO network.

- Out-of-network providers or services are not covered (except in emergencies).

- If you live in California and are interested in the Kaiser HMO Option, make sure to review how the Kaiser plan provisions differ from the UHC options.

Network Exclusive Option

Available only to current enrollees

- The UHC Network Exclusive Option provides benefits that are available exclusively when an in-network provider is used.

- There is no coverage when care is provided by an out-of-network provider, except in the case of a life- threatening emergency.

- This option is not available to new enrollees.

- CVS Caremark administers the prescription drug plan.

To find out if a provider is in-network, go to myuhc.com and look under the UHC Choice Plus Network. To find providers in the Kaiser HMO network, go to kp.org.

View a detailed 2026 Medical Plan Options Comparison Chart

Prescription Drug Benefits

Zoetis provides quality prescription drug coverage for the medical plan options through our prescription drug plan, which is administered by CVS Caremark and Kaiser and includes:

- Retail pharmacy-filled prescriptions

- Mail order prescriptions

Under Affordable Care Act provisions, certain preventive drugs are covered at 100% (applies to all Zoetis medical plan options). For more information:

- UHC Options: caremark.com

- Kaiser HMO Option: kp.org

Specialty Drugs and Prior Authorization—UHC

If your provider prescribes a specialty drug, you must obtain prior authorization. This means that the prescribing provider will need to answer questions about your medical condition or diagnosis before the drug is dispensed.

You or your provider must submit the prescription, then CVS Caremark Specialty Pharmacy will reach out to your provider for the necessary clinical information for Prior Authorization within 48 hours to ensure your medication is reviewed and processed. For more information on CVS Caremark Specialty Pharmacy services, visit caremark.com.

Specialty Drugs—Kaiser

$35 per prescription up to 30-day supply, subject to formulary guidelines. No prior authorization required.

Specialty Drugs Copay Program (Prudent Rx)

The PrudentRx Specialty Copay Program helps make high-cost specialty medications more affordable. If you take specialty drugs for conditions like cancer, rheumatoid arthritis or other serious conditions, this voluntary program could significantly reduce your out-of-pocket costs.

How it helps

- $0 copays: Members who join the program typically pay nothing outof-pocket for eligible specialty medications.

- Easy enrollment: PrudentRx will help you enroll in manufacture assistance programs and handle all the paperwork.

- Ongoing support: They’ll manage renewals and make sure you have access to your medications.

How to get started

If you take specialty medications, CVS Caremark and PrudentRx will contact you directly.

Diabetes and Weight Loss Drugs

- For diabetes GLP-1s: You may need prior approval from CVS Caremark before getting diabetes medications like Ozempic® and Mounjaro® if you’re not currently taking other diabetes medication like Metformin.

- For weight loss medications: You may need prior approval from CVS Caremark before getting weight loss medications like Contrave,® Phentermine,® Qsymia,® Saxenda,® Wegovy,® Xenical,® Zepbound,® etc.

ID Cards

- You will receive a new medical ID card if you are newly enrolling or changing your coverage level.

- If changing your coverage level (e.g., from “You” to “You + Spouse/ Domestic Partner”) or if adding/removing dependents as covered dependents, they will be listed on the medical ID card.

- Temporary cards can be printed from the UHC or Kaiser sites once your enrollment is registered.

- You may also receive a CVS Caremark Prescription Drug ID card.

- If you live in Southern CA and enroll in Kaiser, you will receive two ID cards, Northern CA and Southern CA. When receiving services in Southern CA, use your Southern CA ID card, except for chiropractic and infertility services, when the Northern CA card should be used.

For those enrolled in a UHC medical plan option

The UHC premier advocacy team includes specialty trained advocates and registered nurses assigned to work with Zoetis health plan members. This team of registered nurses and advocates is specially trained to understand how your Zoetis health benefits work and are well-equipped to help you and your family navigate and understand your health care benefits.

Call an advocate for questions like:

- What does my plan cover?

- Where should I go for care?

- Can you help me understand this claim?

- What steps should I take next?

To reach an advocate:

- Call the member number at 888-470-8079, Monday-Friday, 8am-11pm ET

- Log in to myuhc.com® and click to call or chat with an Advocate, or open the UnitedHealthcare® app for assistance on the go

You have access to world-renowned specialists for their opinion when faced with a challenging medical condition for you and your parents, grandparents, siblings, and adult children of both you and your spouse/domestic partner.

Connect with a 2nd.MD expert medical doctor for a video or phone consultation when you have questions about:

- A new diagnosis

- Changes in your treatment plan

- A chronic condition

2nd.MD’s specialist network includes physicians from top hospitals, such as Boston Children’s Hospital, Memorial Sloan Kettering, Johns Hopkins, Cleveland Clinic, and many more.

To access 2nd.MD, visit 2nd.MD or call 866-269-3534.

With a Virtual Visit, you can see and talk to a doctor via mobile device or computer—24/7, no appointment needed. The doctor can give you a diagnosis and prescription, if necessary. Virtual Visits are covered just like a regular office visit. UHC Virtual Visits providers are board-certified doctors through Teladoc®, American Well (Amwell®), and Doctor On Demand™. To learn more or to get started with a UHC Virtual Visit, go to uhc.com/virtualvisits 24/7, no appointment needed.

When you use the UHC app you can complete a Virtual Visit without leaving the app. The UHC app is available for download, at no cost, from your app store.

Virtual Visits are subject to office visit copays and coinsurance.

Virtual Visits—Kaiser HMO Option

Virtual Visits are provided through the Kaiser provider network. Visit kp.org or call 1-800-464-4000, TTY 711 for more information. Virtual Visits are covered at no cost.

UHC recognizes doctors and medical centers that specialize in certain conditions, deliver the highest-level medical care, and are nationally recognized for quality results as Centers of Excellence (COEs). With UHC’s clinical support programs and Centers of Excellence, you receive support and advice with finding the best bariatric, cancer treatment, centers for transplants, fertility, and congenital heart disease resources.

UHC also provides Clinical Programs that support kidney problems, maternity, and neonatal needs.

These programs are available anytime if you are enrolled in one of the UHC medical plan options. Call 1-888-470-8079 to learn more.

Quit for Life is a smoking cessation program that uses interactive content and a digital platform to help curb tobacco and nicotine dependency.

This clinically proven program includes:

- Unlimited access to a coach via phone, text and messaging

- Group video sessions designed to bring community and shared support

- A dashboard to help employees engage with the program

To enroll, call 1-866-QUIT4LIFE (784-8454).

Ilant Health provides you and your covered dependents access to specialized doctors, dieticians and mental health clinicians who focus specifically on cardiometabolic care — weight management, diabetes and heart health — at no cost you.

What Makes Ilant Special

- Expert care team: Ilant’s board-certified doctors, mental health professionals and registered dietitians specialize in metabolic health and offer their expertise through the convenience of virtual healthcare.

- Personalized attention: Ilant matches each patient with the right treatment plan from day one, accounting for each person’s unique lifestyle and needs. This can include access to medications, such as GLP-1s, surgery or lifestyle programs.

- Peer support: Improving your metabolic health can be hard, but it doesn’t have to be lonely. You can access peer support groups plus a peer navigator who has lived experience with obesity.

- Always available: “On demand” means care is available during extended hours, including weekends, with dedicated peer navigator support.

- Better results: Patients typically see better weight loss, blood pressure control and diabetes management when using Ilant’s evidence-based approach. They also experience more energy and greater mental wellbeing.

In addition to obesity, diabetes and cardiovascular health programs, Ilant also offers a Prevention program for those looking to proactively pursue a healthy lifestyle using behavior change, nutrition and physical activity delivered by clinical specialists.

How to Get Started

Go to ilanthealth.com/zoetis or contact Ilant’s Member Support team at 1-866-933-3122 or support@ilanthealth.com with any questions.

Progyny provides you with enhanced fertility, family-building and pregnancy/postpartum support benefits. With concierge support from a dedicated care team, access to care from expert providers and exclusive resources in the Progyny app, Progyny is your partner across life’s milestones.

What Progyny Offers

- Cycle-based coverage: With Smart Cycles, a two-cycle benefit, you won’t need to track your spending and you won’t run out of benefits in the middle of treatment. Each cycle includes all the tests, procedures, medications and follow-up care you need. It also means you get the same great coverage whether you live in a high-cost or low-cost area.

- Complete services: IVF, egg freezing, adoption, surrogacy and pregnancy/postpartum support are all in one place.

- Adoption and surrogacy assistance: Whether you’re just starting your research, ready to begin the process or are well on your way in your adoption or surrogacy journey, a Progyny coach can provide counseling, review your options and more.

- Dedicated support: Progyny Care Advocates (PCAs) guide you through every step of your journey.

How to Get Started

Go to progyny.com/benefits to learn more.

This benefit from Sword can help you address musculoskeletal, pelvic and/or migraine pain at its source, providing deep and lasting results – at no cost to you.

Sword offers an end-to-end digital physical therapy (PT) platform to prevent and treat musculoskeletal pain. The Sword approach combines clinical expertise with individualized treatment, resulting in 67% of members reporting “pain-free” by the end of their program.

What Sword Offers

- Unlimited usage at no cost to you – no copay and no connection with your medical coverage.

- Customized guidance from a Doctor of Physical Therapy and PT on your terms.

- Anytime, anywhere chat-based connection with a clinical pain specialist for help with musculoskeletal and pelvic pain.

- Videos from trusted experts on topics ranging from preventing injuries to understanding pain to building healthy habits.

How to Get Started

- Visit meet.swordhealth.com/zoetis to activate your free digital PT benefit and opt to download the convenient mobile app.

- Complete your onboarding survey and pick your therapist.

- Receive your kit by mail.

- Work your program from the convenience of your own home.

- Enjoy the benefits of less pain!

Eligibility

- Sword is available to colleagues and dependents enrolled in a Zoetis health plan (UHC or Kaiser).

- Dependents must be at least 13 years old to participate in the Sword physical therapy program and at least 18 years old to participate in the Sword pelvic health program.

To get started, visit meet.swordhealth.com/zoetis.

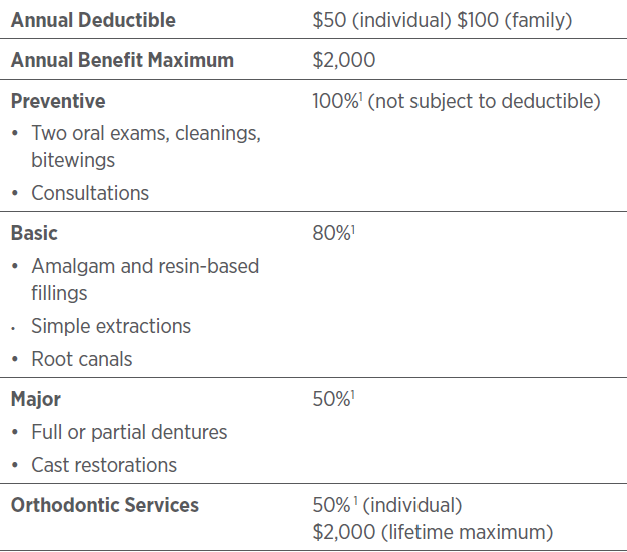

Zoetis offers a Preferred Provider Organization (PPO) dental option administered by MetLife. You have the option of using in- or out-of-network dental providers with the same level of benefit.

Dental plan features

1 Reasonable & Customary allowance applies

Visit a MetLife Preferred Dentist

The MetLife Preferred Dentist Program (PDP) network provides access to more than 118,000 dental practices nationwide—and more than 28,000 are specialists. PDP dentists have agreed to network-negotiated fees for services provided. PDP dentist care lowers your out-of-pocket costs. And, you do not have to submit claim forms—the dentist’s office does the work for you. Find a PDP near you at metlife.com/mybenefits.

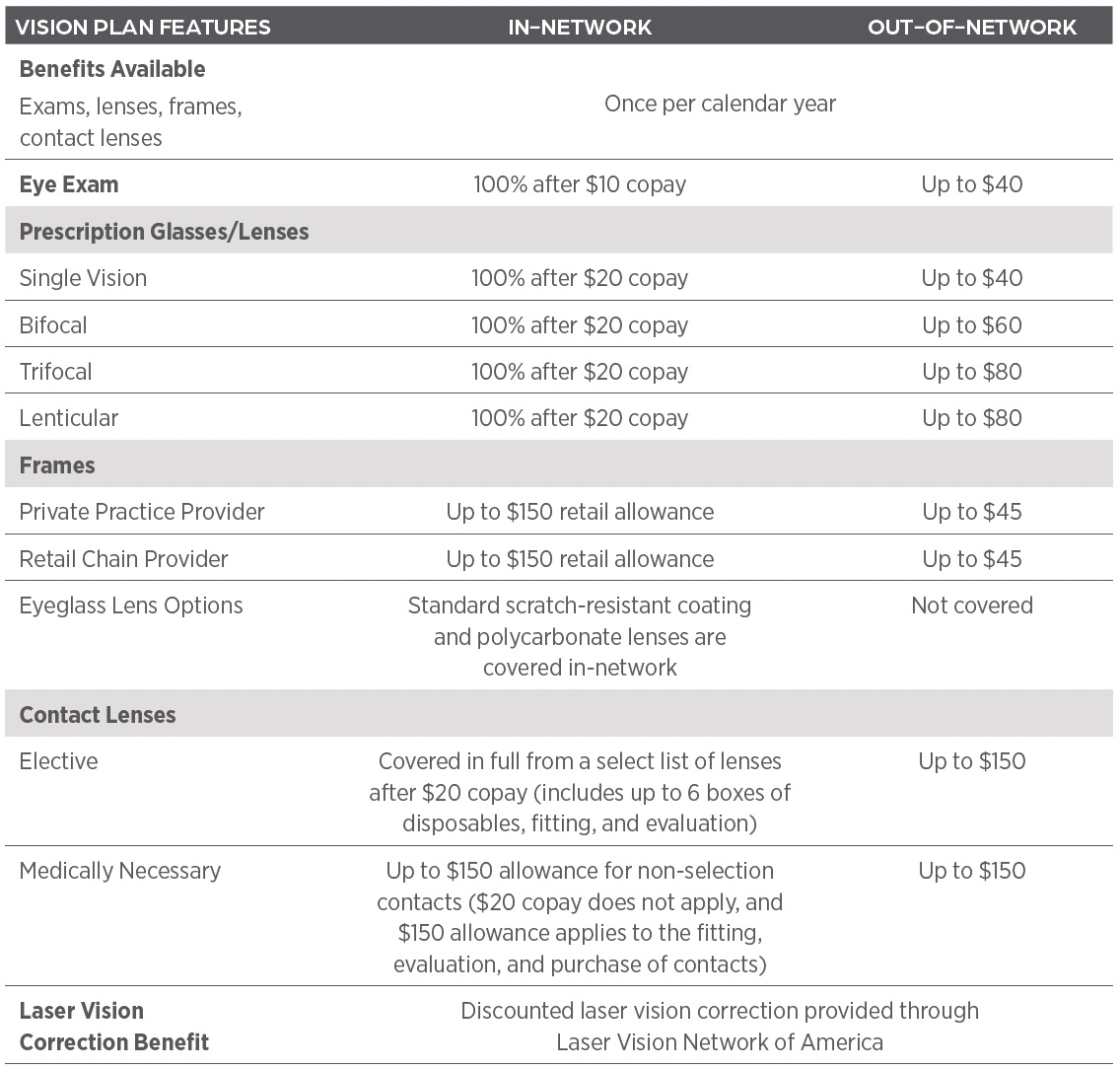

UnitedHealthcare (UHC) Vision administers the Zoetis Vision Plan.

Note: The $150 retail allowance can be applied to the purchase of frames or non-formulary contact lenses. Members cannot receive both glasses and contacts in the same benefits plan year.

Save on Vision Care

You can receive discounts on eye care services and products at LensCrafters, Pearle Vision, Sears Optical, JCPenney Optical, and other participating providers, with no cost to participate in the discount program. Simply say “Zoetis” at participating providers when receiving services. This optional program does not replace or coordinate with the Zoetis-sponsored vision program through UHC Vision.

Only available if you are enrolled in the Health Savers Option

Zoetis contributes to your HSA and you can also make per-paycheck contributions to your HSA on a pre-tax basis, subject to annual IRS limits. You can use the money in your HSA to cover a significant portion of the annual deductible and other out-of-pocket medical costs. You can also choose to save your HSA for future medical expenses and even use it in retirement.

Triple tax advantage. The HSA allows you to contribute pre-tax money, earn tax-free interest on savings, and pay no taxes on amounts spent from the HSA on qualified expenses.

Zoetis contributions. Zoetis will contribute $600 per year to your HSA if you are enrolled in Employee Only coverage and $1,200 per year for other coverage levels (Employee + Spouse/Domestic Partner, Employee + Child(ren), Family). (New hires who begin employment July 1 through November 30 are eligible to receive 50% ($300 Employee Only, $600 other coverage levels) of Zoetis HSA contributions for that calendar year. New hires who begin employment December 1 or later are not eligible to receive Zoetis HSA contributions for that calendar year.)

Your contributions. For 2026, you can also contribute up to $3,800 per year for Employee Only coverage and $7,550 per year for other coverage levels. These contributions can be made through payroll deductions.

|

Coverage Level |

From Zoetis1 |

From You (Optional) |

IRS Contribution Maximum |

|---|---|---|---|

|

Employee Only |

$600 |

$3,800 |

$4,500 |

|

All other coverage levels |

$1,200 |

$7,550 |

$8,750 |

1 New hires who begin employment December 1 or later are not eligible to receive Zoetis HSA contributions for that calendar year.

Opening Your HSA

If you enroll in the Health Savers Option be sure to accept the terms and conditions for Optum Bank on the Your Benefits Matter enrollment portal and the Optum Bank HSA will automatically be opened for you. You will also receive an HSA Payment Card that you will be able to use to pay for expenses anywhere Mastercard® is accepted. You will be able to reimburse yourself from your HSA by logging in to your account at myuhc.com. You can expect the Zoetis contribution in your HSA the month following your enrollment.

Use the Optum Bank HSA calculator (welcometouhc.com/zoetis) to determine your maximum contribution and estimate your tax savings.

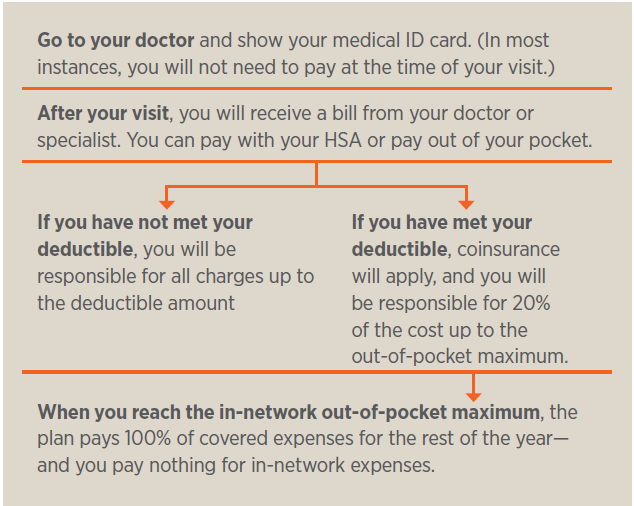

Using Your HSA

Here’s how the Health Savers Option with HSA works when you receive in-network care.

Learn More

Go to welcometouhc.com/zoetis to watch short videos about HSAs and how they work. You can also access other materials to help you better understand HSAs.

HSA Eligibility

According to the Internal Revenue Service, to contribute to an HSA, you cannot be enrolled in Medicare, TRICARE, or other health coverage that is not a qualifying high-deductible plan, and you cannot be claimed as a dependent on someone else’s tax return. Consult a tax, legal, or financial advisor to discuss your personal circumstances.

For more information about HSA eligibility, go to welcometouhc.com/zoetis and refer to Publication 969 at irs.gov/publications/p969.

Note: If you enroll in the Health Savers Option with an HSA, you can change your HSA payroll contribution election at any time of year without needing a Qualified Life Event.

Not available if you are enrolled in the Health Savers Option

The Health Care FSA, administered by Optum, provides a way to pay for eligible medical, prescription drug, dental and vision expenses with pre-tax dollars. With deductions taken on a pre-tax basis, taxable income is reduced, and you pay less in taxes.

You can elect to contribute up to $3,300 for 2026 in pre-tax dollars to the Health Care FSA to reimburse yourself for eligible healthcare expenses for yourself and your dependents. For a complete list of eligible FSA healthcare expenses, visit irs.gov/publications/p502.

The IRS considers the Health Care FSA to be a “use-it-or-lose-it” account, which means you must incur eligible expenses and submit claims for reimbursement within the applicable time frames to avoid forfeiture of your funds.

Eligible expenses must be incurred from January 1 to December 31 to be considered for reimbursement. The deadline for filing your claims for reimbursement is March 31 of the following year.

To participate, you must enroll and elect your annual contribution amount during enrollment. Your election does not automatically carry over from year to year.

Only available if you are enrolled in the Health Savers Option

Similar to the traditional Health Care FSA, this account is another way to set aside pre-tax dollars. The main differences between the two FSAs is the LPFSA funds can only be used for eligible dental and vision expenses and is available only if you enroll in the Health Savers Option.

You can elect to contribute up to $3,300 for 2026 in pre-tax dollars to the LPFSA to reimburse yourself for eligible healthcare expenses for yourself and your dependents.

The IRS considers the Limited Purpose FSA to be a “use-it-or-lose-it” account, which means you must incur eligible expenses and submit claims for reimbursement within the applicable time frames to avoid forfeiture of your funds.

Eligible expenses must be incurred from January 1 to December 31 to be considered for reimbursement. The deadline for filing your claims for reimbursement is March 31 of the following year.

To participate, you must enroll and elect your annual contribution amount during enrollment. Your election does not automatically carry over from year to year. A Limited Purpose FSA may be something you want to consider if you want to maximize your HSA savings for future use.

Zoetis provides income and financial protection through the following disability insurance benefits:

- Short-Term Disability (STD) Insurance

- Long-Term Disability (LTD) Insurance

Short-Term Disability (STD) Insurance

If you cannot work due to an illness or injury, STD benefits will provide 100% of your base pay up to the first 13 weeks of disability and 70% of base pay for the remaining period, up to a maximum of 26 weeks. STD benefits are administered by NYLife. This benefit is fully paid by Zoetis, and no colleague contributions are required.

Long-Term Disability (LTD) Insurance

If an illness or injury keeps you out of work for longer than 26 weeks, the Zoetis provided Core Benefit will deliver 60% of your base pay. This coverage can be supplemented with the Optional Buy-up Benefit, which instead provides 70% of your total pay (including bonus and commissions) up to a monthly maximum as indicated in the following table. LTD benefits are administered by NYLife.

Pre-existing conditions

LTD benefits will not be paid for any period of disability that begins within 12 months of your benefit effective date or date of any added or increased benefits if that disability is associated with a pre-existing condition. A pre-existing condition is defined as an injury or illness for which you received treatment or diagnostic care or used prescription drugs or medicines within three months prior to the most recent effective date of insurance coverage. If you have any questions, contact NYLife at 1-888-842-4462.

Need to be out of work due to a disability or leave?

Call NYLife at 1-888-842-4462 to report a disability or to request a Family Medical or Zoetis leave of absence.

This insurance, offered through MetLife, provides a lump sum payment if you are diagnosed with cancer, heart attack, stroke or several other critical illnesses such as kidney failure, Alzheimer’s Disease and ALS.

You can elect this coverage as a new hire, at annual enrollment or if you have a qualifying life event.

Zoetis does not contribute to the cost of these benefits.

Access to retiree medical benefits is available through the Retiree Health Access® (RHA®) Program for eligible colleagues. RHA is a national group of business and industry leaders working together to offer health solutions powered by Aetna. Zoetis retirees will be able to choose from retiree-paid pre- and post-age 65 Aetna medical options that include prescription drug coverage. You’ll be able to choose a plan that best meets your health and financial needs regardless of your current health status. You’ll also have coverage for preventive care and wellness programs designed to help you live a healthier lifestyle.

You are eligible if you retire at or after age 55 with at least five years of continuous service and are covered under a Zoetis medical plan just prior to retirement. If you are COBRA-eligible at retirement and wish to enroll first in COBRA medical benefits, you can delay enrollment into the RHA Program until the time your COBRA benefits expire (typically 18 months following retirement).

The RHA/Aetna Program does not impact colleagues who are already eligible for retiree medical coverage from Pfizer, or who will become eligible for retiree medical coverage through Pfizer during the grow-in period that ended December 31, 2017. The RHA/Aetna Program simply provides options to consider amongst other medical plans available, including those on the Affordable Care Act exchange market.

Questions about the plans, billing, eligibility and enrollment can be directed to the RHA Retiree Service Center at 1-800-426-4584 (TTY/TDD: 711). Their Customer Service Representative will review plan options and benefits and provide you access to their site for retiree plan modeling and information.

For colleagues enrolled in a UHC medical plan, One Pass Select makes staying healthy fun and affordable by giving you access to thousands of fitness locations nationwide. Whether you prefer yoga, strength training, swimming, or spin classes, there’s something for everyone at every fitness level. This voluntary program is available to you and eligible family members (18+) through a simple online registration process.

Choose Your Membership Tier

One Pass Select offers five membership options to fit different lifestyles and budgets:

- Digital – Access to digital fitness apps and online classes

- Classic – 12,000+ gym locations nationwide

- Standard – 14,000+ gym and premium locations

- Premium – 16,000+ gym and premium locations

- Elite – 19,000+ gym and premium locations

Go to OnePassSelect.com to see membership tier pricing. All Classic tier and above memberships include the digital tier, grocery delivery, and additional benefits at no extra cost.

What’s Included

Beyond fitness centers, your One Pass Select membership provides access to grocery delivery to your home, digital fitness apps with streaming classes, group fitness classes at participating locations, and access to premium studios (varies by tier). The program is designed to make healthy living convenient and accessible, giving you flexibility to try new activities and find what works best for you.

Getting Started

Setting up your One Pass Select membership is simple:

- Visit OnePassSelect.com and click “Get started”

- Register or log in – Log in with your UHC HealthSafe ID (the user id and password used to sign into the UHC member site)

- Get your member code from the dashboard page

- Learn how to use it by clicking “How to use code” to access all your services

Important note: You must register with One Pass Select before visiting fitness centers or registering for classes.

Making the Most of Your Membership

To maximize your membership value, consider signing up at the beginning of the month since memberships aren’t prorated. You can also enter your ZIP code on OnePassSelect.com to discover available fitness options in your area. For example, a search in the Parsippany, NJ area shows more than 50 gym options across different membership tiers.

Need Help?

If you have questions about One Pass Select, contact Zoetis Colleague Services at zoetiscolleagueservices@zoetis.com or 855-984-7463.