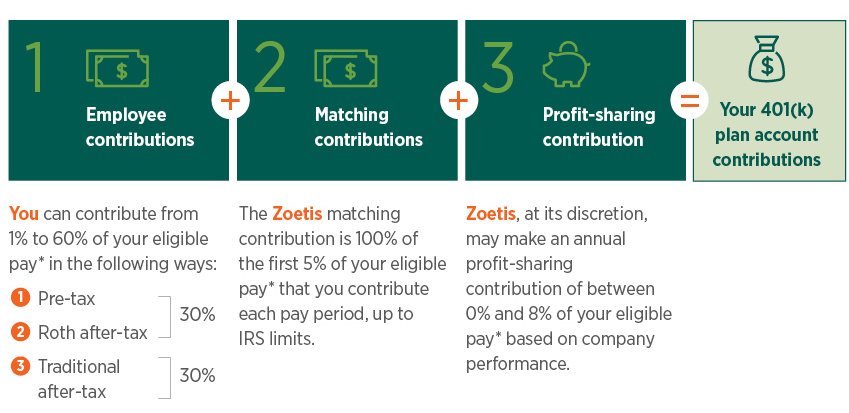

The Zoetis Savings Plan is a defined-contribution plan, administered by Merrill, that allows you to make pre-tax, Roth after-tax or traditional after-tax contributions, or a combination of the three.

Eligible active colleagues can designate a percentage of their pay that they would like to contribute. Besides being a convenient way to save for retirement, the Zoetis Savings Plan also provides tax advantages, as your contributions may be tax-deferred up to IRS limits.

How the Plan Works

Your Savings Plan account can be funded in three ways:

* Eligible pay includes your compensation from Zoetis, such as base pay, overtime pay, shift differential, and bonus. See the plan document for a full description.

Get the Most Value from Your Savings Plan Account

Contribute at least 5% of your eligible pay* throughout the year to receive the full company match. Once you reach the IRS annual contribution limit, your contributions stop and you could miss out on company matching dollars for the remainder of the year. To receive the full company match:

- Elect a contribution percentage that spaces out your contributions over the entire year, or

- Change to traditional after-tax contributions once you reach the IRS limit so you can continue to contribute to the plan and receive the company match on those contributions, or

• Elect the spillover feature, which automatically converts your pre-tax and/or after-tax Roth contributions to traditional after-tax contributions.

* Eligible pay includes your compensation from Zoetis, such as base pay, overtime pay, shift differential, and bonus. See the plan document for a full description.

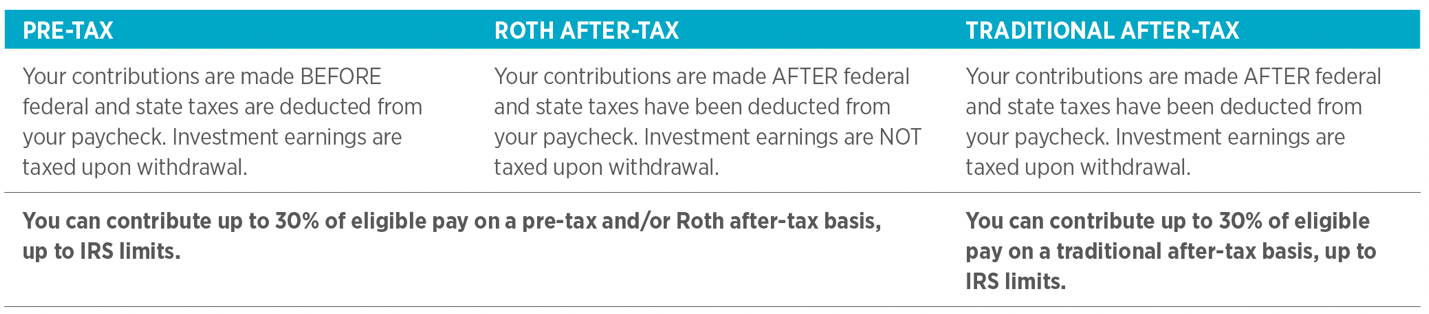

Types of Employee Contributions

You can contribute to your Savings Plan account through one or a combination of three contribution options. The difference between each is based on how the money is taxed when contributed and how investment earnings are taxed when distributed.

Automatic Increase Feature

You may elect to participate in the automatic increase feature of the Savings Plan. This feature automatically increases your contributions by a percentage you select. The increase will occur each year on the anniversary of your enrollment date unless you elect otherwise.

NEW! In-Plan Roth Conversion Feature

Our plan now offers a feature that lets you have pre-tax and traditional after-tax contributions converted to a Roth account within the Savings Plan. In addition, the feature allows you to make an election that will convert your future traditional after-tax contributions to a Roth account on a per payroll basis.

Learn more about this feature.

Vesting

Vesting means you own your account and can take those funds with you if you leave Zoetis. Vesting in the Savings Plan occurs in two phases:

- You are immediately vested in your contributions and any company matching contributions.

- You become vested in profit-sharing contributions from Zoetis at a rate of 20% per year of service until 100% vested after five years of service.

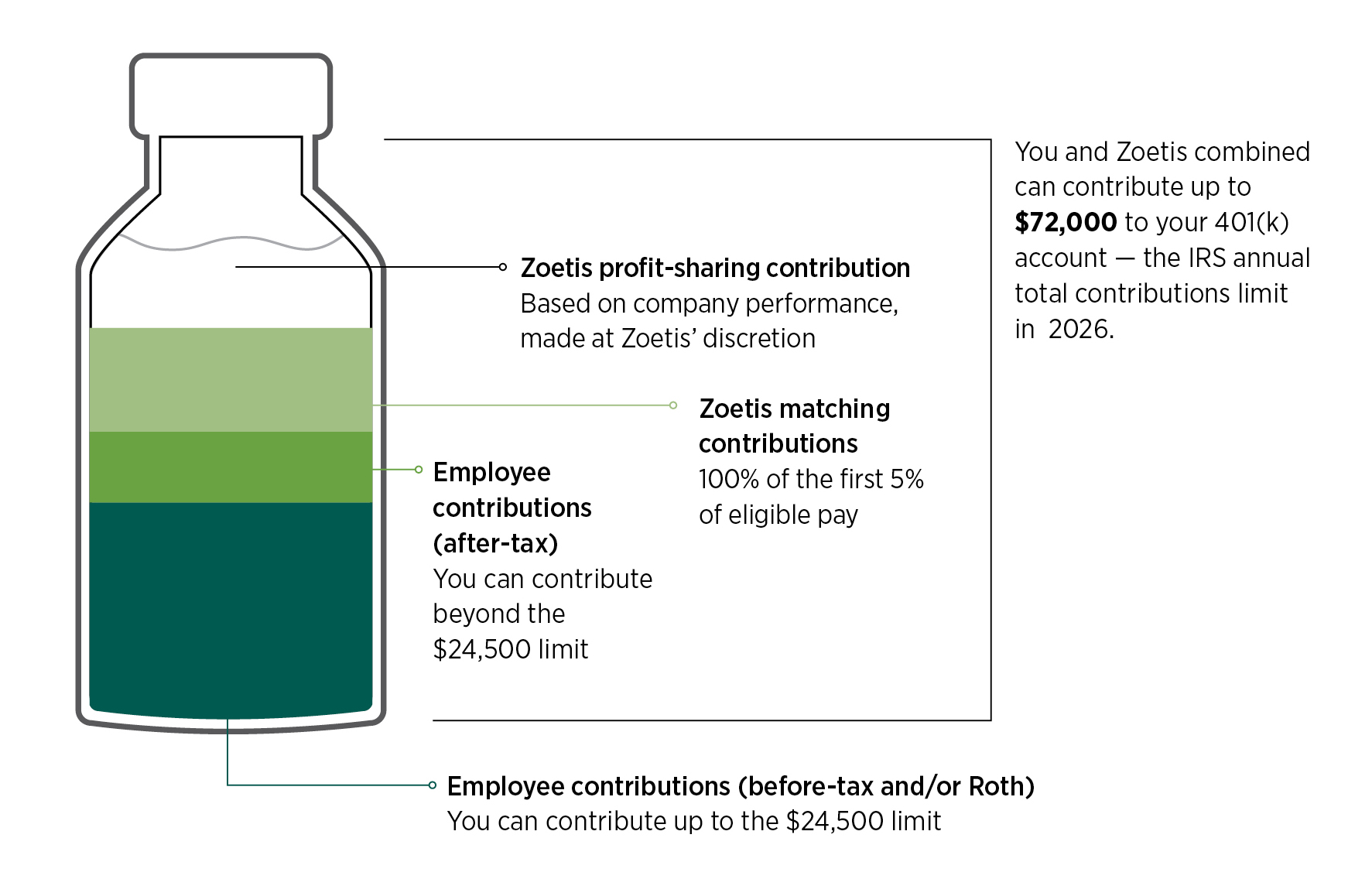

IRS Limits

The IRS limits how much you and the company can contribute to your Savings Plan account each year.

- Annual total contributions limit: $72,000

- Catch-up employee contributions (must be elected within your Merrill account):

– Age 50-59 and 64+: $8,000

– Age 60-63: $11,250

– Note that if you turn age 50 or older in 2026 and your 2025 FICA wages (Box 3 on your 2025 form W-2) were above $150,000, catch-up contributions must be made as Roth after-tax contributions. If your 2025 FICA wages were $150,000 or less, you can choose to make catch-up contributions as pre-tax and/or Roth. Learn more. - Compensation limit: $360,000

- Combined before-tax and Roth employee contributions limit: $24,500

Important: If you contributed to another 401(k) plan before joining Zoetis in the same year, that amount counts toward your contribution limit for the year. It is your responsibility to track your total contributions when contributing to different 401(k) plans.

How Contributions Work with IRS Limits

How your employee contributions plus company contributions work together can be complicated. Especially with IRS limits. Here’s an overview of how they can add up (start from the bottom and move up).

Investment Options

You can direct the investment of your funds in the Savings Plan among the plan’s investment options, which can be viewed within the investments tab of your Merrill account. If you enroll in the plan, but do not elect investment options, your contributions and Zoetis contributions will be invested in the plan’s default investment fund.

Taking Money Out of Your Savings Plan Account

If you need to withdraw money from your Savings Plan account, you have three options available.

- Loans: You can apply to take up to two loans (general purpose or home loan) at any one time.

- Withdrawals: Generally, you can withdraw after-tax and rollover amounts from your account. Certain other funds are available if you are at least age 59½, disabled, or qualify for a hardship withdrawal. When you take a withdrawal, you’ll owe taxes on the amount of the withdrawal. You also may owe an additional 10% early withdrawal penalty if you are younger than age 59½.

- Distribution: When you leave Zoetis, you may elect a distribution of your vested account balance. Those funds can be rolled over into an Individual Retirement Account (IRA) or another employer’s 401(k) plan. You can also choose to leave your Savings Plan account with Zoetis; IRS limits will apply. Certain restrictions and fees may apply.

Choosing Your Beneficiaries

It is important that you name your beneficiary(ies) when you enroll in the Savings Plan. To name or change your beneficiary, log into your Merrill account, select Plan Services > Beneficiary.

Financial Planning

A Merrill Financial Solutions Advisor is available to discuss financial planning, net worth, liquidity planning, asset allocation, and retirement. Sign up at go.ml.com/ScheduleConsultation or call 1-800-228-4015 and ask about the Personalized Financial Outlook service.

Zoetis provides income and financial protection through the following disability insurance benefits:

- Short-Term Disability (STD) Insurance

- Long-Term Disability (LTD) Insurance

Short-Term Disability (STD) Insurance

If you cannot work due to an illness or injury, STD benefits will provide 100% of your base pay up to the first 13 weeks of disability and 70% of base pay for the remaining period, up to a maximum of 26 weeks. STD benefits are administered by NYLife. This benefit is fully paid by Zoetis, and no colleague contributions are required.

Long-Term Disability (LTD) Insurance

If an illness or injury keeps you out of work for longer than 26 weeks, the Zoetis-provided Core Benefit will deliver 60% of your base pay. This benefit is fully paid by Zoetis, and no colleague contributions are required. This coverage can be supplemented with the Optional Buy-up Benefit, which instead provides 70% of your total pay (including bonus and commissions) up to a monthly maximum as indicated in the following table. You are responsible for paying for the additional 10% of coverage. LTD benefits are administered by NYLife.

|

LTD Benefits |

|

|---|---|

|

Zoetis-provided Core Benefit |

60% of base pay, up to a maximum monthly benefit of $25,000 (company-paid) |

|

Optional Buy-up Benefit |

70% of total pay, up to a maximum monthly benefit of $29,167 (colleague contribution required) |

Your cost for the Optional Buy-up Benefit is based on the amount of your total pay. Since contributions are pre-tax, any benefit payments you receive should you become disabled will generally be taxable.

Pre-existing conditions

LTD benefits will not be paid for any period of disability that begins within 12 months of your benefit effective date or date of any added or increased benefits if that disability is associated with a pre-existing condition. A pre-existing condition is defined as an injury or illness for which you received treatment or diagnostic care or used prescription drugs or medicines within 3 months prior to the most recent effective date of insurance coverage. If you have any questions, contact NYLife at 1-888-842-4462.

Need to be out of work due to a disability or leave?

Call NYLife at 1-888-842-4462 to report a disability or to request a Family Medical or Zoetis leave of absence.

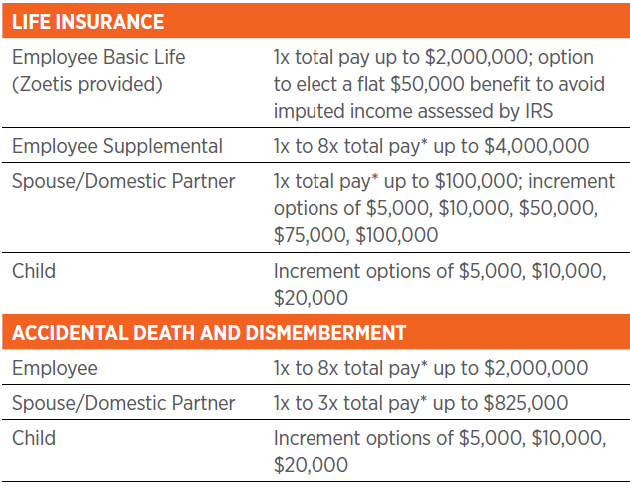

Zoetis provides Employee Basic Life Insurance at no cost to you—and other optional life and accidental death and dismemberment benefits for you and your family that you pay for. All are insured through Prudential. For Employee Supplemental and/or Spouse/Domestic Partner Life Insurance, evidence of insurability (EOI) may be required based on the coverage you select.

* Total pay is regular base pay and performance-related bonuses, sales commissions, premium pay, shift differential and overtime paid in a 12-month period.

Your cost for supplemental life insurance benefits is based on your age, smoking status, and benefit amount elected.

Only available if you are enrolled in the Health Savers Option

Zoetis contributes to your HSA and you can also make per-paycheck contributions to your HSA on a pre-tax basis, subject to annual IRS limits. You can use the money in your HSA to cover a significant portion of the annual deductible and other out-of-pocket medical costs. You can also choose to save your HSA for future medical expenses and even use it in retirement.

Triple tax advantage. The HSA allows you to contribute pre-tax money, earn tax-free interest on savings, and pay no taxes on amounts spent from the HSA on qualified expenses.

Zoetis contributions. Zoetis will contribute $600 per year to your HSA if you are enrolled in Employee Only coverage and $1,200 per year for other coverage levels (Employee + Spouse/Domestic Partner, Employee + Child(ren), Family). (New hires who begin employment July 1 through November 30 are eligible to receive 50% ($300 Employee Only, $600 other coverage levels) of Zoetis HSA contributions for that calendar year. New hires who begin employment December 1 or later are not eligible to receive Zoetis HSA contributions for that calendar year.)

Your contributions. For 2026, you can also contribute up to $3,800 per year for Employee Only coverage and $7,550 per year for other coverage levels. These contributions can be made through payroll deductions.

|

Coverage Level |

From Zoetis1 |

From You (Optional) |

IRS Contribution Maximum |

|---|---|---|---|

|

Employee Only |

$600 |

$3,800 |

$4,500 |

|

All other coverage levels |

$1,200 |

$7,550 |

$8,750 |

1 New hires who begin employment December 1 or later are not eligible to receive Zoetis HSA contributions for that calendar year.

Opening Your HSA

If you enroll in the Health Savers Option be sure to accept the terms and conditions for Optum Bank on the Your Benefits Matter enrollment portal and the Optum Bank HSA will automatically be opened for you. You will also receive an HSA Payment Card that you will be able to use to pay for expenses anywhere Mastercard® is accepted. You will be able to reimburse yourself from your HSA by logging in to your account at myuhc.com. You can expect the Zoetis contribution in your HSA the month following your enrollment.

Use the Optum Bank HSA calculator (welcometouhc.com/zoetis) to determine your maximum contribution and estimate your tax savings.

Using Your HSA

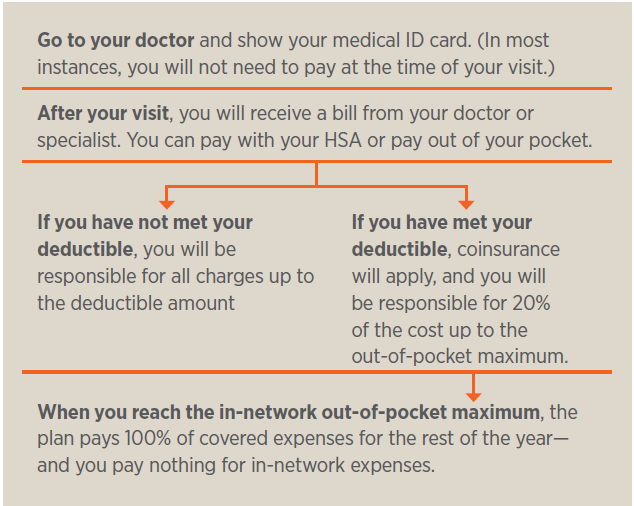

Here’s how the Health Savers Option with HSA works when you receive in-network care.

Learn More

Go to welcometouhc.com/zoetis to watch short videos about HSAs and how they work. You can also access other materials to help you better understand HSAs.

HSA Eligibility

According to the Internal Revenue Service, to contribute to an HSA, you cannot be enrolled in Medicare, TRICARE, or other health coverage that is not a qualifying high-deductible plan, and you cannot be claimed as a dependent on someone else’s tax return. Consult a tax, legal, or financial advisor to discuss your personal circumstances.

For more information about HSA eligibility, go to welcometouhc.com/zoetis and refer to Publication 969 at irs.gov/publications/p969.

Note: If you enroll in the Health Savers Option with an HSA, you can change your HSA payroll contribution election at any time of year without needing a Qualified Life Event.

Not available if you are enrolled in the Health Savers Option

The Health Care FSA, administered by Optum, provides a way to pay for eligible medical, prescription drug, dental and vision expenses with pre-tax dollars. With deductions taken on a pre-tax basis, taxable income is reduced, and you pay less in taxes.

You can elect to contribute up to $3,300 for 2026 in pre-tax dollars to the Health Care FSA to reimburse yourself for eligible healthcare expenses for yourself and your dependents. For a complete list of eligible FSA healthcare expenses, visit irs.gov/publications/p502.

The IRS considers the Health Care FSA to be a “use-it-or-lose-it” account, which means you must incur eligible expenses and submit claims for reimbursement within the applicable time frames to avoid forfeiture of your funds.

Eligible expenses must be incurred from January 1 to December 31 to be considered for reimbursement. The deadline for filing your claims for reimbursement is March 31 of the following year.

To participate, you must enroll and elect your annual contribution amount during enrollment. Your election does not automatically carry over from year to year.

Only available if you are enrolled in the Health Savers Option

Similar to the traditional Health Care FSA, this account is another way to set aside pre-tax dollars. The main differences between the two FSAs is the LPFSA funds can only be used for eligible dental and vision expenses and is available only if you enroll in the Health Savers Option.

You can elect to contribute up to $3,300 for 2026 in pre-tax dollars to the LPFSA to reimburse yourself for eligible healthcare expenses for yourself and your dependents.

The IRS considers the Limited Purpose FSA to be a “use-it-or-lose-it” account, which means you must incur eligible expenses and submit claims for reimbursement within the applicable time frames to avoid forfeiture of your funds.

Eligible expenses must be incurred from January 1 to December 31 to be considered for reimbursement. The deadline for filing your claims for reimbursement is March 31 of the following year.

To participate, you must enroll and elect your annual contribution amount during enrollment. Your election does not automatically carry over from year to year. A Limited Purpose FSA may be something you want to consider if you want to maximize your HSA savings for future use.

The Dependent Day Care FSA, administered by Optum, provides a way to pay for your and your dependents’ eligible day care expenses with pre-tax dollars. With deductions taken on a pre-tax basis, taxable income is reduced, and you pay less in taxes.

You can elect to contribute up to $5,000 per plan year (or $2,500 per plan year if you are married and file separate tax returns) on a pre-tax basis to the Dependent Day Care FSA. This option helps pay for expenses, such as day care, summer day camps and nanny services when provided to children under age 13, as well as elder care services that enable you and your spouse, if applicable, to go to work.

The IRS considers the Dependent Day Care FSA to be a “use-it-or-lose-it” account, which means you must incur eligible expenses and submit claims for reimbursement within the applicable time frames to avoid forfeiture of your funds.

Eligible expenses must be incurred from January 1 to December 31 to be considered for reimbursement. The deadline for filing your claims for reimbursement is March 31 of the following year.

To participate, you must enroll and elect your annual contribution amount. Your election does not automatically carry over from year to year.

Debit Cards

- If you enroll in the Health Care and/or Dependent Day Care FSA, you will receive a single debit card that you can use to pay for eligible FSA expenses.

- If you open an Optum Bank HSA, you will receive one debit card that will be linked to these eligible accounts—your HSA, your Dependent Day Care FSA, and/or your Limited Purpose FSA.

You can use your debit card where Mastercard is accepted. Claims can also be submitted for transactions where debit cards are not accepted.

A Commuter Expense Reimbursement Account (CERA)—administered by Optum Bank—lets you pay for eligible commuting and parking expenses with pre-tax dollars via paycheck deductions. Your savings depend on your commuting expenses, tax situation, and the monthly limits set by the IRS.

The 2026 IRS pre-tax limits are:

- $340 per month for parking expenses

- $340 per month for public transportation expenses

Use your CERA for:

- Public transit services such as bus, light rail, regional rail, streetcar, trolley, subway, or ferry*

- Vanpool

- Parking at or near work or public transportation if you commute to work

The CERA works with any transit system and almost any parking provider or vanpool, nationwide. Here’s how it works:

- Deductions will be taken from the first paycheck of the month.

- You will be able to review your situation monthly and make changes as needed to support your commuting and parking expenses.

- If you terminate employment, any unused pre-tax balance will be forfeited as required by the IRS—any post-tax contributions remaining will be refunded.

- You will be able to set up a recurring order that will automatically generate your commuter order or pay your contracted parking vendor. If your commuting needs change, you will be able to adjust or discontinue your order.

* Tolls are not included as the account allows only for public transit expenses.

Enrollment Instructions:

If enrolled in a Zoetis UnitedHealthcare medical plan: Sign-on to Optum Bank through myuhc.com®. > Claims & Accounts > Financial Accounts >“CERA” link on the top of the page to be redirected to the Optum Bank website.

If not enrolled in a Zoetis UnitedHealthcare medical plan: Login directly to optumbank.com and create a user name and password for account access. Once you are in the Optum Bank site, click on Transportation Services or Accounts tab, then “Overview.”

The recognition of your service to Zoetis is important. The Zoetis Service Award Program is designed to recognize and reward colleagues with a special gift and message when they have worked at Zoetis for five years and at each fifth anniversary.

The Zoetis Matching Gifts Program matches eligible colleague donations dollar-for-dollar—up to $1,000 per year, to eligible 501(c)(3) tax-exempt organizations—effectively doubling your contributions. Zoetis uses Benevity—a third party platform—to facilitate matching gifts. All new colleagues will receive a welcome email with instructions to create a Benevity account and get started. For more details, refer to the Zoetis Matching Gifts Policy.

For referring someone to a role at Zoetis, you may be eligible to receive a $2,000 referral bonus. See the Employee Referral Program policy document for complete terms and eligibility.

This all-in-one digital security solution is provided through MetLife and Aura, and includes identity theft and fraud protection, scam

and cybercrime prevention, smart family safety and resolution and reimbursement features.

You can elect this coverage as a new hire, at annual enrollment or if you have a qualifying life event.

This coverage, offered through MetLife, includes preparation of wills, trusts, house closings, traffic offenses and divorce. With MetLife Legal Plans Plus Parents, you can cover parents, parents-in-law and grandparents for many common legal issues.

You can elect this coverage as a new hire, at annual enrollment or if you have a qualifying life event.

Zoetis offers discounted home, auto, umbrella, renters and personal property insurance policies through MetLife, Liberty Mutual and Travelers.

You can enroll as a new hire or at any time during the year.

The Zoetis Business Travel Accident (BTA) insurance plan provides you and your family with services and financial protection if you experience a loss, injury, or medical emergency while traveling on business.

For international medical emergency assistance, contact International SOS at 1-215-942-8226.

To submit a Business Travel Accident claim, email ACEAandHClaims@chubb.com or call 1-800-336-0627 and refer to Zoetis policy # ADDN0498402A.

Pet Insurance

You can enroll in discounted pet insurance as a new hire and at any time during the year through Pumpkin. You will receive a Pumpkin discount of 10% for your first pet and 20% discount for all additional pets. Just go to pumpkin.care/teams and enter code ZOETIS or call 1-866-ARF-MEOW (1-866-273-6369).

Platinum Performance® Product Discount Program

Support the daily health and wellness of your animals with advanced nutrition from Platinum Performance®. Zoetis colleagues may receive 20% off Platinum Performance® foundation formulas for dogs, cats and horses when enrolled in the Platinum Nutritional Benefit Program.

Please visit platinumperformance.com/zoetis at any time to see eligible products and instructions on how to enroll in the Platinum Performance® Nutritional Benefit Program.

Explore an extensive network of exclusive deals on everyday living expenses — from computers and gifts to theme parks and hotels. You can enjoy hundreds of discounts from local and national retailers. Learn more at zoetis.corestream.com.